Navigating the world of cryptocurrency can feel like stepping into the future, filled with exciting opportunities and innovative technologies. But with this brave new world comes a crucial responsibility: understanding and managing your crypto taxes. Ignoring your tax obligations could lead to penalties and legal issues, so let’s break down the complexities of crypto taxes and empower you to stay compliant.

Understanding Crypto as Property and Tax Implications

The Internal Revenue Service (IRS) classifies cryptocurrency as property, not currency. This seemingly simple distinction has significant implications for how your crypto activities are taxed. Think of it like stocks or real estate – each transaction can trigger a taxable event.

Taxable Events in the Crypto World

Many crypto transactions trigger a taxable event. It’s essential to understand which activities require reporting. Here are a few common examples:

- Selling cryptocurrency for fiat currency (USD, EUR, etc.): This is the most common taxable event. If you sell Bitcoin for dollars, you’ll realize a capital gain or loss based on the difference between your purchase price (basis) and the sale price.

Example: You bought 1 Bitcoin for $10,000 and sold it for $40,000. You have a capital gain of $30,000.

- Trading one cryptocurrency for another: Exchanging Bitcoin for Ethereum, even if you don’t cash out to traditional currency, is considered a sale. Each trade is a taxable event.

Example: You trade 2 ETH (basis of $1,000 each) for 0.5 BTC (fair market value of $2,000 each). You have a capital gain of $2,000 (0.5BTC $2,000 – $2,000 = $2,000).

- Using cryptocurrency to purchase goods or services: This is treated as selling your crypto and then using the proceeds to buy something.

Example: You buy a laptop for $2,000 worth of Bitcoin. Your original Bitcoin purchase price was $1,500. You have a capital gain of $500.

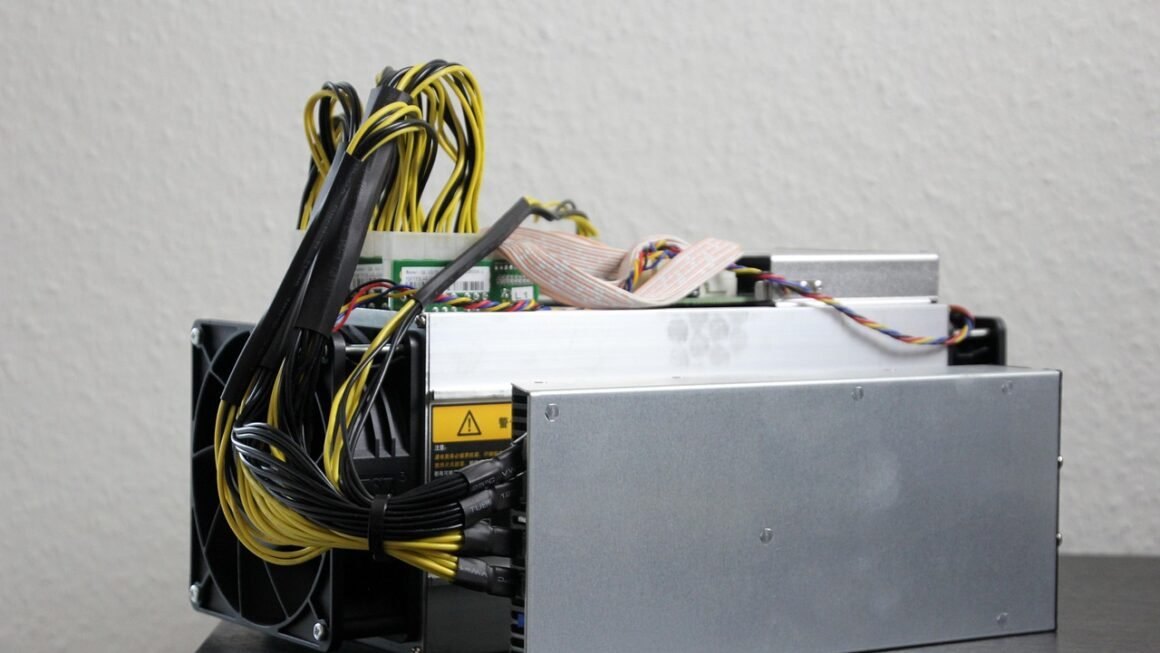

- Mining cryptocurrency: If you successfully mine cryptocurrency, the fair market value of the coins at the time you gain control over them is considered taxable income.

Example: You mine 1 ETH and its value is $2,000 at the time you gain access to it. You have $2,000 in taxable income.

- Earning cryptocurrency as income: Receiving crypto as payment for services or as a reward is generally taxed as ordinary income.

Example: You are paid 0.1 BTC for freelance work. The value of 0.1 BTC at the time of receipt is $4,000. You have $4,000 in ordinary income.

Non-Taxable Events

Not all crypto activities are taxable. These usually include:

- Buying cryptocurrency with fiat currency: Simply purchasing crypto is not a taxable event until you sell, trade, or use it.

- Donating cryptocurrency to a qualified charity: You can often deduct the fair market value of the donated cryptocurrency, subject to certain limitations.

- Transferring cryptocurrency between your own wallets: Moving crypto between wallets you own doesn’t trigger a taxable event.

Capital Gains and Losses: Short-Term vs. Long-Term

Understanding the difference between short-term and long-term capital gains is crucial for calculating your crypto taxes. This distinction significantly impacts the tax rate you’ll pay.

Short-Term Capital Gains

- Definition: Profits from selling cryptocurrency held for one year or less.

- Tax Rate: Taxed at your ordinary income tax rate, which can range from 10% to 37% depending on your income bracket.

- Example: You bought Ethereum for $1,000 in January and sold it for $1,500 in September of the same year. Your $500 profit is a short-term capital gain and will be taxed at your ordinary income tax rate.

Long-Term Capital Gains

- Definition: Profits from selling cryptocurrency held for more than one year.

- Tax Rate: Typically lower than ordinary income tax rates, ranging from 0% to 20% depending on your income bracket. Some high-income earners may also be subject to the 3.8% Net Investment Income Tax (NIIT).

- Example: You bought Bitcoin for $10,000 in January 2022 and sold it for $40,000 in March 2023. Your $30,000 profit is a long-term capital gain and will be taxed at a potentially lower rate than your ordinary income.

Capital Loss Deduction

Both short-term and long-term capital losses can be used to offset capital gains. If your capital losses exceed your capital gains, you can deduct up to $3,000 (or $1,500 if married filing separately) of the excess loss from your ordinary income each year. Any remaining losses can be carried forward to future tax years.

Determining Your Cost Basis

Your cost basis is the original price you paid for your cryptocurrency, including any fees or commissions. Accurately tracking your cost basis is essential for calculating your capital gains or losses.

Importance of Accurate Record-Keeping

- Calculating gains/losses: Knowing your cost basis is critical for determining the difference between what you paid and what you sold your crypto for.

- Avoiding overpayment: Inaccurate records can lead to overpaying your taxes.

- IRS scrutiny: The IRS is increasing its focus on crypto taxation. Maintaining accurate records will help you avoid potential audits and penalties.

Methods for Calculating Cost Basis

- First-In, First-Out (FIFO): Assumes the first cryptocurrency you bought is the first cryptocurrency you sold. This is often the default method.

- Last-In, First-Out (LIFO): Assumes the last cryptocurrency you bought is the first cryptocurrency you sold. While allowed for certain inventory management, it is generally not accepted for crypto.

- Specific Identification: Allows you to specifically identify which units of cryptocurrency you are selling. This can be beneficial for tax optimization, especially if you purchased crypto at varying prices. You need to properly document which specific units you are selling.

Example: You bought 1 BTC at $10,000 and another BTC at $20,000. If you sell one BTC for $25,000, you can specifically identify which BTC you are selling (the one with the $10,000 basis or the one with the $20,000 basis) to minimize your tax liability.

Tracking Your Transactions

- Spreadsheets: A simple way to manually track your crypto transactions.

- Crypto tax software: Automates the process of tracking transactions and calculating taxes. Examples include CoinTracker, TaxBit, and ZenLedger.

- Exchange records: Most cryptocurrency exchanges provide transaction histories, which can be helpful but may not be comprehensive (especially if you use multiple exchanges).

Reporting Crypto on Your Tax Return

Failing to report your cryptocurrency transactions can result in penalties and interest. The IRS is actively working to improve its ability to track and enforce crypto tax compliance.

Relevant Tax Forms

- Form 8949 (Sales and Other Dispositions of Capital Assets): Used to report capital gains and losses from the sale of crypto.

- Schedule D (Capital Gains and Losses): Summarizes your capital gains and losses from Form 8949.

- Form 1040 (U.S. Individual Income Tax Return): Used to report your overall income, including any income from crypto mining or staking.

- Schedule 1 (Additional Income and Adjustments to Income): Used to report income from mining, staking, or other crypto-related activities.

Understanding the Crypto Question on Form 1040

Form 1040 now includes a question about digital assets. This question is designed to help the IRS identify taxpayers who may have unreported crypto transactions.

- The Question: “At any time during [Year], did you receive, sell, exchange, or otherwise dispose of any financial interest in any digital asset?”

- Importance: Answering truthfully is crucial. Failing to answer honestly could lead to penalties.

Filing Accuracy and Common Mistakes

- Inaccurate cost basis: Using the wrong cost basis can lead to incorrect capital gains or losses.

- Forgetting about trades: Many people forget that trading one cryptocurrency for another is a taxable event.

- Not reporting income from mining or staking: This income is taxable and must be reported.

- Ignoring wash sale rules: While not specifically applied to crypto yet, wash sale rules could potentially apply to crypto transactions in the future. It’s prudent to be aware of them.

Wash Sale Rule: Prevents you from claiming a loss on a sale if you buy a “substantially identical” asset within 30 days before or after the sale. This rule is common for stocks.

Conclusion

Navigating crypto taxes can seem daunting, but with a solid understanding of the rules and diligent record-keeping, you can confidently manage your tax obligations. Remember to treat cryptocurrency like other property, track your cost basis accurately, and report all taxable events on your tax return. If you’re unsure about any aspect of crypto taxes, consulting with a qualified tax professional is always a wise decision. Staying informed and proactive is the key to successfully navigating the evolving landscape of cryptocurrency taxation.