Bitcoin has revolutionized the financial landscape, introducing the world to decentralized digital currency. Understanding Bitcoin, its underlying technology, and its potential impact is crucial in today’s rapidly evolving financial environment. Whether you are a seasoned investor or simply curious about cryptocurrency, this guide will provide a comprehensive overview of Bitcoin.

What is Bitcoin?

Bitcoin is a decentralized digital currency, meaning it’s not controlled by a single entity like a central bank. It operates on a technology called blockchain, a distributed public ledger that records all transactions. This makes it transparent and secure, as every transaction is verifiable and immutable.

The Genesis of Bitcoin

- Bitcoin was created in 2009 by a person or group known as Satoshi Nakamoto.

- The whitepaper outlining the concept of Bitcoin was released in 2008.

- The first Bitcoin transaction occurred on January 12, 2009, between Satoshi Nakamoto and Hal Finney.

How Bitcoin Works

- Decentralization: Bitcoin operates on a peer-to-peer network, eliminating the need for intermediaries.

- Blockchain Technology: All Bitcoin transactions are recorded on a public, distributed ledger called the blockchain.

- Mining: New Bitcoins are created through a process called mining, where computers solve complex mathematical problems to validate transactions and add new blocks to the blockchain.

Key Features of Bitcoin

- Decentralized: Not controlled by any single entity.

- Limited Supply: Only 21 million Bitcoins will ever be created, making it potentially deflationary.

- Transparent: All transactions are recorded on the public blockchain.

- Secure: Cryptographic techniques ensure the security of transactions.

- Global: Can be sent and received anywhere in the world.

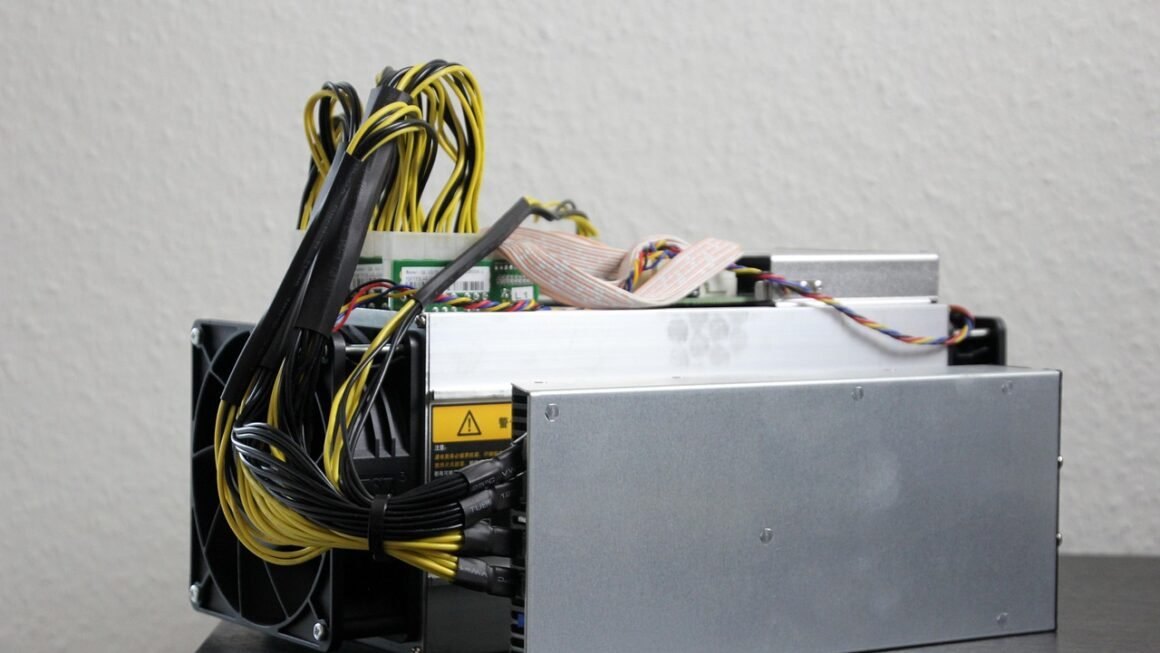

Understanding Bitcoin Mining

Bitcoin mining is the process by which new bitcoins are created and transactions are verified and added to the blockchain. Miners use powerful computers to solve complex cryptographic puzzles.

The Role of Miners

- Miners validate transactions and add new blocks to the blockchain.

- They compete to solve complex mathematical problems.

- The first miner to solve the problem gets to add the next block to the blockchain and is rewarded with newly minted Bitcoin.

- This process secures the network and prevents fraudulent transactions.

Mining Hardware and Software

- ASIC Miners: Specialized hardware designed specifically for Bitcoin mining.

- Mining Software: Programs that connect miners to the Bitcoin network and facilitate the mining process.

- Mining Pools: Groups of miners who combine their computing power to increase their chances of solving blocks and earning rewards.

Example: Joining a mining pool can provide more consistent, albeit smaller, payouts than mining solo.

Energy Consumption

- Bitcoin mining consumes a significant amount of energy.

- There are ongoing debates and efforts to make Bitcoin mining more sustainable.

- Renewable energy sources, such as solar and wind power, are increasingly being used for mining.

Buying and Storing Bitcoin

Acquiring and securely storing Bitcoin are essential steps for anyone looking to invest in or use the cryptocurrency. Choosing the right platforms and wallets can significantly impact the safety and accessibility of your Bitcoin holdings.

How to Buy Bitcoin

- Cryptocurrency Exchanges: Platforms like Coinbase, Binance, and Kraken allow you to buy Bitcoin using fiat currency (e.g., USD, EUR).

- Peer-to-Peer Marketplaces: Platforms like LocalBitcoins connect buyers and sellers directly, allowing for more personalized transactions.

- Bitcoin ATMs: Physical kiosks that allow you to purchase Bitcoin with cash or debit cards.

Types of Bitcoin Wallets

- Hardware Wallets: Physical devices that store your private keys offline, offering a high level of security. (e.g., Ledger Nano S, Trezor)

- Software Wallets: Applications that can be installed on your computer or smartphone. (e.g., Exodus, Electrum)

- Online Wallets: Web-based wallets that are accessible from any device but may be more vulnerable to security breaches. (e.g., Coinbase Wallet, Blockchain.com Wallet)

- Paper Wallets: Printouts of your private and public keys, stored offline for maximum security.

Security Best Practices

- Enable two-factor authentication (2FA) on your exchange and wallet accounts.

- Use strong, unique passwords for all your accounts.

- Keep your private keys safe and offline whenever possible.

- Be wary of phishing scams and other fraudulent activities.

Bitcoin’s Use Cases and Applications

Bitcoin has evolved beyond a speculative asset and is increasingly being used in various real-world applications. Understanding these use cases can help you appreciate the versatility of Bitcoin.

As a Store of Value

- Bitcoin is often compared to gold as a store of value.

- Its limited supply and decentralized nature make it attractive as a hedge against inflation and economic uncertainty.

- Investors are increasingly allocating a portion of their portfolio to Bitcoin as a long-term investment.

As a Medium of Exchange

- Bitcoin can be used to purchase goods and services from merchants that accept it as payment.

- The number of merchants accepting Bitcoin is growing.

- Cross-border transactions can be faster and cheaper with Bitcoin compared to traditional methods.

Decentralized Finance (DeFi)

- Bitcoin is used as collateral in DeFi platforms.

- Wrapped Bitcoin (WBTC) allows Bitcoin to be used on the Ethereum blockchain.

- Bitcoin-backed loans and other financial services are emerging.

Remittances

- Bitcoin can be used to send money internationally, often at a lower cost and faster speed than traditional remittance services.

- This is particularly beneficial for individuals sending money to developing countries.

Example: Sending money from the US to El Salvador can be significantly cheaper using Bitcoin compared to traditional wire transfers.

The Future of Bitcoin

The future of Bitcoin is subject to various factors, including regulatory developments, technological advancements, and market adoption. However, its potential to transform the financial landscape remains significant.

Regulatory Landscape

- Government regulations can have a significant impact on the adoption and use of Bitcoin.

- Some countries have embraced Bitcoin, while others have imposed restrictions or outright bans.

- Clarity in regulation is needed to foster innovation and growth in the Bitcoin ecosystem.

Scalability Solutions

- The Bitcoin network’s scalability has been a topic of discussion.

- Solutions like the Lightning Network are being developed to enable faster and cheaper transactions.

- Improved scalability will be crucial for Bitcoin to become a mainstream payment method.

Institutional Adoption

- Institutional investors are increasingly allocating capital to Bitcoin.

- This trend is expected to continue as Bitcoin matures and becomes more widely accepted.

- Institutional adoption can provide greater stability and legitimacy to the Bitcoin market.

Environmental Concerns

- The environmental impact of Bitcoin mining is a growing concern.

- Efforts are being made to transition to more sustainable mining practices.

- The use of renewable energy sources for mining is gaining traction.

Conclusion

Bitcoin represents a significant innovation in the world of finance. Its decentralized nature, limited supply, and transparent blockchain technology offer unique advantages. While challenges remain, such as regulatory uncertainty and scalability issues, the potential of Bitcoin to transform the financial landscape is undeniable. Whether you are an investor, a technologist, or simply curious, understanding Bitcoin is essential in today’s rapidly evolving digital world. By staying informed and following best practices, you can navigate the world of Bitcoin with confidence and make informed decisions.