Bitcoin. The word itself often conjures images of digital gold, revolutionary technology, and a complex financial system. But beyond the hype, what is Bitcoin really? This blog post delves into the core concepts, benefits, and potential drawbacks of the world’s first cryptocurrency, providing you with a comprehensive understanding of this groundbreaking innovation. Whether you’re a curious beginner or a seasoned investor, prepare to unravel the intricacies of Bitcoin and its impact on the future of finance.

What is Bitcoin?

Understanding the Basics

Bitcoin is a decentralized digital currency, operating without a central bank or single administrator. It uses cryptography for security and is recorded on a public, distributed ledger called a blockchain. In simpler terms, it’s like digital cash that’s secured by code and verified by a network of computers.

- Decentralized: No single entity controls Bitcoin. This makes it resistant to censorship and government interference.

- Cryptographic: Bitcoin uses advanced encryption techniques to secure transactions and control the creation of new units.

- Blockchain: Every Bitcoin transaction is permanently recorded on the blockchain, making it transparent and auditable.

- Example: Imagine sending money to a friend. With traditional banking, a bank acts as an intermediary, verifying the transaction and updating account balances. With Bitcoin, the transaction is broadcast to the entire network, verified by multiple computers (nodes), and added to the blockchain.

How Bitcoin Transactions Work

Bitcoin transactions are initiated by users through a digital wallet. This wallet contains the user’s private key, which is used to digitally sign the transaction. The transaction is then broadcast to the Bitcoin network.

- Digital Wallet: Software or hardware used to store, send, and receive Bitcoin. Popular examples include Ledger Nano X (hardware wallet) and Exodus (software wallet).

- Private Key: A secret code that allows you to access and spend your Bitcoin. Keep it safe, as anyone who has it can control your Bitcoin.

- Transaction Fee: A small fee paid to the Bitcoin network to incentivize miners to include the transaction in a block.

- Example: You want to send 0.5 BTC to a vendor. You use your Bitcoin wallet to create a transaction, digitally sign it with your private key, and broadcast it to the network. Miners then compete to include this transaction in a block.

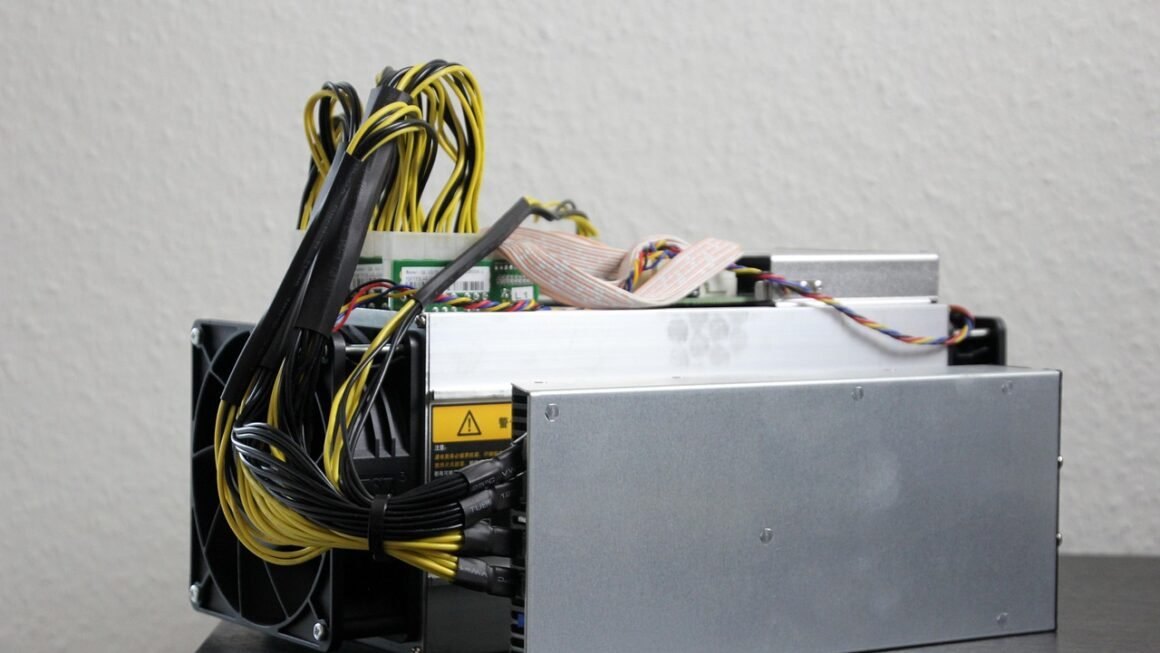

Bitcoin Mining and Proof-of-Work

Bitcoin mining is the process of verifying and adding new transactions to the blockchain. Miners use powerful computers to solve complex mathematical problems, which allows them to create new blocks. In return for their efforts, miners are rewarded with newly minted Bitcoin and transaction fees.

- Proof-of-Work (PoW): The consensus mechanism used by Bitcoin. Miners must expend computational power to solve a puzzle, proving they have done the work to secure the network.

- Block Reward: The amount of Bitcoin given to miners for each new block they create. This reward halves approximately every four years (a process called “halving”).

- Difficulty Adjustment: The Bitcoin network automatically adjusts the difficulty of the mining puzzle to maintain a consistent block creation time of around 10 minutes.

- Example: A mining pool like Antpool combines the resources of many miners to increase their chances of solving a block. When they successfully mine a block, they share the reward proportionally among the pool members.

The Benefits of Bitcoin

Decentralization and Security

One of the primary advantages of Bitcoin is its decentralized nature. This eliminates the need for intermediaries and reduces the risk of censorship or control by any single entity.

- No Central Authority: Bitcoin operates without a central bank or government, making it resistant to manipulation.

- Immutable Blockchain: Once a transaction is recorded on the blockchain, it cannot be altered or reversed, ensuring transparency and security.

- Global Network: Bitcoin transactions can be sent and received anywhere in the world, without the need for traditional banking systems.

- Example: In countries with unstable political systems or high inflation rates, Bitcoin can provide a more reliable and secure store of value compared to the local currency.

Transparency and Anonymity

While Bitcoin transactions are recorded on a public ledger, the identity of the users involved is not directly revealed. Transactions are associated with wallet addresses rather than personal information.

- Pseudonymous Transactions: Bitcoin transactions are linked to wallet addresses, not personal identities, providing a degree of privacy.

- Public Ledger: All Bitcoin transactions are publicly viewable on the blockchain, allowing for transparency and auditability.

- Enhanced Privacy Options: Techniques like CoinJoin and using Tor can further enhance privacy when using Bitcoin.

- Example: A journalist in a country with strict censorship laws might use Bitcoin to anonymously receive funds for their work, protecting them from government surveillance.

Potential for Investment

Bitcoin’s limited supply (21 million coins) and increasing adoption have led to its appreciation in value over time. Many investors view Bitcoin as a store of value and a hedge against inflation.

- Limited Supply: The scarcity of Bitcoin makes it potentially resistant to inflation.

- Increasing Adoption: As more businesses and individuals accept Bitcoin, its value could increase.

- Diversification: Bitcoin can be a useful addition to a diversified investment portfolio.

- Example: If you had invested $1000 in Bitcoin in 2010, it would be worth millions of dollars today. While past performance is not indicative of future results, this illustrates the potential for significant returns.

The Challenges of Bitcoin

Volatility and Price Fluctuations

Bitcoin’s price is known for its volatility, which can make it a risky investment. The price can fluctuate significantly in short periods, leading to potential losses.

- Market Sentiment: Bitcoin’s price is heavily influenced by market sentiment and news events.

- Regulatory Uncertainty: Regulatory developments in different countries can impact Bitcoin’s price.

- Limited Liquidity: While improving, the liquidity of Bitcoin markets can still be lower than that of traditional financial assets.

- Example: In May 2021, Bitcoin’s price plummeted by over 30% in a single day due to negative news regarding its environmental impact and regulatory concerns.

Scalability and Transaction Speed

Bitcoin’s transaction speed is relatively slow compared to traditional payment systems. The Bitcoin network can only process a limited number of transactions per second, leading to potential delays and higher transaction fees during periods of high demand.

- Limited Block Size: Bitcoin’s block size is limited to 1MB, which restricts the number of transactions that can be included in each block.

- Slow Transaction Times: Bitcoin transactions typically take around 10 minutes to be confirmed, and sometimes longer during peak periods.

- Scalability Solutions: Solutions like the Lightning Network are being developed to improve Bitcoin’s scalability and transaction speed.

- Example: During a major market crash, the Bitcoin network can become congested, leading to delays in transaction confirmations and higher fees. Using the Lightning Network can enable faster and cheaper transactions.

Regulatory Uncertainty and Security Risks

The regulatory landscape surrounding Bitcoin is still evolving, and governments around the world are taking different approaches to regulating cryptocurrencies. Additionally, Bitcoin exchanges and wallets are vulnerable to hacking and theft.

- Evolving Regulations: Regulatory uncertainty can create challenges for Bitcoin businesses and investors.

- Security Vulnerabilities: Bitcoin exchanges and wallets can be targets for hackers.

- Private Key Security: If you lose your private key, you lose access to your Bitcoin.

- Example: In 2014, the Mt. Gox Bitcoin exchange collapsed after suffering a major hack, resulting in the loss of hundreds of millions of dollars worth of Bitcoin.

How to Buy and Store Bitcoin

Choosing a Bitcoin Exchange

There are many Bitcoin exchanges available, each offering different features, fees, and security measures. It’s important to choose a reputable exchange with a strong track record.

- Coinbase: A popular exchange known for its user-friendly interface and security features.

- Binance: A global exchange offering a wide range of cryptocurrencies and trading options.

- Kraken: A well-established exchange known for its security and advanced trading features.

- Example: Before choosing an exchange, research its reputation, security measures, fees, and the cryptocurrencies it supports.

Setting Up a Bitcoin Wallet

A Bitcoin wallet is essential for storing, sending, and receiving Bitcoin. There are different types of wallets available, each offering varying levels of security and convenience.

- Hardware Wallets: These are physical devices that store your private keys offline, providing the highest level of security.

- Software Wallets: These are apps or programs that store your private keys on your computer or mobile device.

- Exchange Wallets: These are wallets provided by cryptocurrency exchanges. While convenient, they are less secure than hardware or software wallets.

- Example: A Ledger Nano X hardware wallet is considered a secure option for storing Bitcoin offline.

Securing Your Bitcoin

Protecting your Bitcoin is crucial. Implement strong security measures to prevent theft or loss.

- Enable Two-Factor Authentication (2FA): This adds an extra layer of security to your exchange and wallet accounts.

- Use Strong Passwords: Use unique and complex passwords for all your Bitcoin-related accounts.

- Store Your Private Keys Securely: Keep your private keys offline and in a safe place.

- Be Wary of Phishing Scams: Be cautious of emails or messages that ask for your private keys or login credentials.

- Example: Never share your private key with anyone, and be suspicious of any communication that asks for it.

Conclusion

Bitcoin represents a significant innovation in the world of finance. Its decentralized nature, cryptographic security, and limited supply offer compelling benefits. However, it’s crucial to be aware of the challenges, including volatility, scalability issues, and regulatory uncertainty. By understanding both the advantages and disadvantages of Bitcoin, you can make informed decisions about whether it’s right for you. As the cryptocurrency landscape continues to evolve, staying informed and vigilant is essential for navigating this exciting and complex world.