Navigating the volatile world of cryptocurrency markets can feel like charting a course through uncharted waters. Price swings can be dramatic, new coins appear daily, and the underlying technology, blockchain, is still evolving. Understanding the dynamics of these markets is crucial whether you’re a seasoned investor or just starting to explore the possibilities. This guide aims to demystify the crypto markets, providing insights and practical advice to help you make informed decisions.

Understanding the Crypto Market

What is Cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography for security. Unlike traditional currencies issued by central banks, cryptocurrencies operate on decentralized technology, typically based on blockchain. Bitcoin, the first and most well-known cryptocurrency, was launched in 2009.

- Key Characteristics:

Decentralization: Not controlled by any single entity.

Cryptography: Secure transactions verified by encryption.

Transparency: Transactions are recorded on a public ledger (blockchain).

Limited Supply: Many cryptocurrencies have a fixed supply, which can affect their value.

- Example: Bitcoin has a fixed supply of 21 million coins, which contributes to its scarcity and potential for long-term value appreciation.

Market Capitalization and Dominance

Market capitalization is a key metric used to evaluate the size and relative importance of different cryptocurrencies. It is calculated by multiplying the current price of a cryptocurrency by its circulating supply. Bitcoin’s market capitalization often serves as a benchmark for the entire crypto market. Market dominance represents the percentage of the total crypto market capitalization held by a particular cryptocurrency.

- Example: If Bitcoin’s market capitalization is $1 trillion and the total crypto market capitalization is $2 trillion, Bitcoin’s dominance is 50%.

- Actionable Takeaway: Monitoring market capitalization and dominance can provide insights into market trends and investor sentiment.

Factors Influencing Crypto Prices

Supply and Demand

Like any market, the price of cryptocurrency is determined by the forces of supply and demand. Limited supply coupled with increasing demand can drive prices up, while increased supply and decreasing demand can lead to price declines.

- Example: When a major company announces it will accept Bitcoin as payment, demand typically increases, potentially leading to a price surge.

- Actionable Takeaway: Pay attention to news and events that could affect the demand for specific cryptocurrencies.

Regulatory Developments

Government regulations play a significant role in shaping the crypto market. Positive regulatory frameworks can foster adoption and stability, while restrictive regulations can hinder growth and innovation.

- Example: If the United States were to approve a spot Bitcoin ETF, it could attract significant institutional investment, potentially boosting Bitcoin’s price. Conversely, a ban on cryptocurrency trading in a major economy could lead to a market downturn.

- Actionable Takeaway: Stay informed about regulatory developments in different countries and regions, as they can significantly impact crypto prices.

Technology and Adoption

Advancements in blockchain technology and increased adoption by businesses and consumers can positively influence the value of cryptocurrencies. New technological features, faster transaction speeds, and wider acceptance can drive demand.

- Example: The Ethereum network’s upgrade to Proof-of-Stake (POS) through the “Merge” improved energy efficiency and scalability, which positively impacted Ethereum’s price and perceived value.

- Actionable Takeaway: Research the technology behind different cryptocurrencies and assess their potential for real-world applications.

Market Sentiment and News

The crypto market is highly sensitive to news and social media sentiment. Positive news, celebrity endorsements, and viral trends can create hype and drive prices up, while negative news, hacks, and scams can trigger sell-offs.

- Example: A tweet from Elon Musk about Dogecoin has often caused significant price fluctuations.

- Actionable Takeaway: Be cautious of hype and “fear of missing out” (FOMO). Conduct your own research and make informed decisions based on solid analysis, not just social media trends.

Key Crypto Market Participants

Retail Investors

Retail investors are individual investors who buy and sell cryptocurrencies for their own accounts. They often drive short-term price fluctuations and are susceptible to market sentiment.

- Tips for Retail Investors:

Start with small amounts and gradually increase your investment as you gain experience.

Diversify your portfolio to reduce risk.

Use reputable exchanges and wallets.

Set realistic goals and manage your emotions.

Institutional Investors

Institutional investors include hedge funds, pension funds, and other large financial institutions that invest in cryptocurrencies. Their participation can bring significant capital and stability to the market.

- Impact of Institutional Investors:

Increased trading volume and liquidity.

Greater market efficiency.

Reduced volatility over time (potentially).

Greater integration with traditional financial markets.

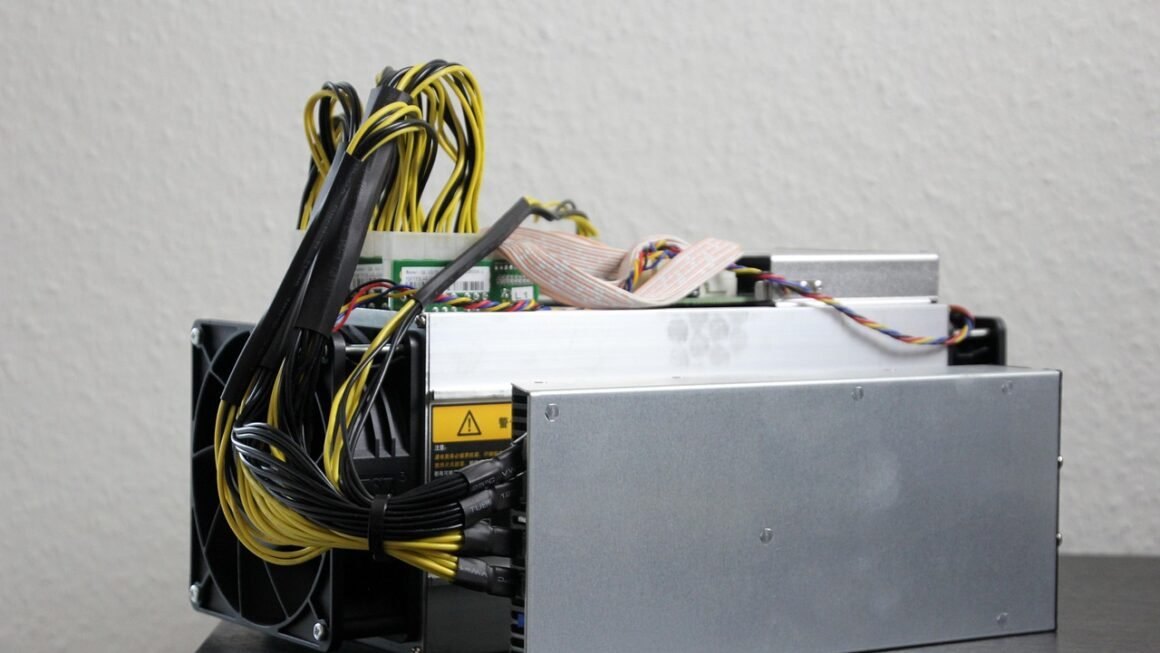

Miners and Validators

Miners (in Proof-of-Work systems like Bitcoin) and validators (in Proof-of-Stake systems like Ethereum) are crucial for maintaining the integrity and security of blockchain networks. They verify transactions and add new blocks to the blockchain, earning rewards in the form of cryptocurrency.

- Importance:

Secure and decentralized networks.

Reliable transaction processing.

Incentive for network participation.

- Actionable Takeaway: Understanding how mining and validation work can help you better appreciate the underlying technology of cryptocurrencies.

Strategies for Investing in Crypto

Dollar-Cost Averaging (DCA)

Dollar-Cost Averaging involves investing a fixed amount of money at regular intervals, regardless of the price. This strategy can help reduce the impact of volatility and potentially improve your average purchase price over time.

- Example: Investing $100 in Bitcoin every week, regardless of its price, can help you accumulate more Bitcoin when the price is low and less when the price is high.

- Actionable Takeaway: DCA is a good strategy for long-term investors who want to avoid timing the market.

Diversification

Diversifying your crypto portfolio by investing in a variety of cryptocurrencies can help reduce risk. Different cryptocurrencies have different use cases, technologies, and market dynamics.

- Example: Instead of putting all your money into Bitcoin, you could allocate some to Ethereum (for smart contracts), Solana (for fast transactions), and Cardano (for research-driven development).

- Actionable Takeaway: Research different cryptocurrencies and choose those that align with your investment goals and risk tolerance.

Long-Term Holding (HODLing)

HODLing is a term used in the crypto community to describe holding cryptocurrencies for the long term, regardless of short-term price fluctuations. This strategy is based on the belief that cryptocurrencies will appreciate in value over time.

- Benefits:

Avoid the stress of day trading.

Potential for long-term capital gains.

Reduced transaction costs.

- Actionable Takeaway: HODLing requires patience and a strong belief in the long-term potential of the cryptocurrencies you hold.

Risk Management

Risk management is essential for any crypto investor. This includes setting stop-loss orders to limit potential losses, using leverage cautiously, and only investing what you can afford to lose.

- Tips for Risk Management:

Set realistic investment goals.

Diversify your portfolio.

Use stop-loss orders.

Avoid excessive leverage.

Secure your crypto assets in a hardware wallet.

Understanding Crypto Market Cycles

Bull Markets

A bull market is characterized by rising prices and positive investor sentiment. During a bull market, demand for cryptocurrencies is high, and prices tend to increase rapidly.

- Characteristics:

Rising prices.

High trading volume.

Positive news and sentiment.

Increased media coverage.

Bear Markets

A bear market is characterized by falling prices and negative investor sentiment. During a bear market, demand for cryptocurrencies is low, and prices tend to decline sharply.

- Characteristics:

Falling prices.

Low trading volume.

Negative news and sentiment.

Decreased media coverage.

Consolidation Phases

Consolidation phases are periods of relative price stability between bull and bear markets. During these phases, prices tend to trade within a narrow range as the market digests previous gains or losses.

- Characteristics:

Sideways price action.

Low volatility.

Uncertainty about future direction.

Accumulation or distribution by smart money.

Recognizing Market Cycles

Identifying market cycles can help investors make more informed decisions about when to buy, sell, or hold cryptocurrencies. Technical analysis tools, such as moving averages and trendlines, can be used to identify potential trend changes.

- Tips for Recognizing Market Cycles:

Monitor price charts and volume data.

Pay attention to news and market sentiment.

Use technical analysis tools.

* Consider macroeconomic factors.

Conclusion

The cryptocurrency market offers both exciting opportunities and significant risks. By understanding the factors that influence crypto prices, the key market participants, and effective investment strategies, you can navigate this dynamic landscape with greater confidence. Remember to conduct thorough research, manage your risk, and stay informed about the latest developments in the crypto space. As with any investment, it’s crucial to make informed decisions based on your individual circumstances and financial goals. Good luck!