Navigating the world of cryptocurrency can feel like charting unknown waters, especially when it comes to taxes. Understanding how crypto transactions are taxed is crucial for compliance and avoiding potential penalties. This guide provides a detailed overview of crypto taxes, helping you navigate the complexities and stay on the right side of the law.

Understanding Crypto as Property

The IRS Perspective

The Internal Revenue Service (IRS) classifies cryptocurrency as property, not currency. This classification has significant implications for how crypto transactions are taxed. Think of it like owning stocks or real estate – the same tax rules apply.

What Does “Property” Mean for Taxes?

- Capital Gains/Losses: When you sell, trade, or otherwise dispose of cryptocurrency, you’ll likely incur a capital gain or loss. The amount depends on the difference between what you paid for it (your cost basis) and what you sold it for.

- Taxable Events: Several crypto activities can trigger taxable events. We’ll delve into specific examples later.

- Reporting Requirements: You’re required to report all taxable crypto transactions on your tax return.

- Example: You bought 1 Bitcoin (BTC) for $20,000. Later, you sell it for $30,000. You have a capital gain of $10,000. This gain needs to be reported on your tax return.

Taxable Crypto Events: What Triggers Them?

Selling Cryptocurrency

Selling crypto for fiat currency (like USD, EUR, etc.) is the most straightforward taxable event. You’ll calculate the capital gain or loss based on the difference between the sale price and your cost basis.

Trading Cryptocurrency

Trading one cryptocurrency for another (e.g., BTC for ETH) is also a taxable event. Each trade is treated as selling the cryptocurrency you’re giving up and buying the cryptocurrency you’re receiving.

- Example: You trade 1 BTC (bought for $20,000) for 20 ETH. At the time of the trade, 20 ETH is worth $30,000. You have a capital gain of $10,000. You now have a cost basis of $30,000 in your 20 ETH.

Using Crypto to Purchase Goods or Services

Using cryptocurrency to buy goods or services is treated as selling the crypto and then using the proceeds to make the purchase.

- Example: You buy a laptop for $1,000 worth of BTC. You originally bought the BTC for $800. You have a capital gain of $200.

Receiving Crypto as Income

If you receive cryptocurrency as payment for goods or services, it’s considered taxable income. The fair market value of the crypto at the time you receive it is reported as income.

- Example: You’re a freelancer, and a client pays you 0.5 BTC for your work. At the time of payment, 0.5 BTC is worth $15,000. You report $15,000 as income.

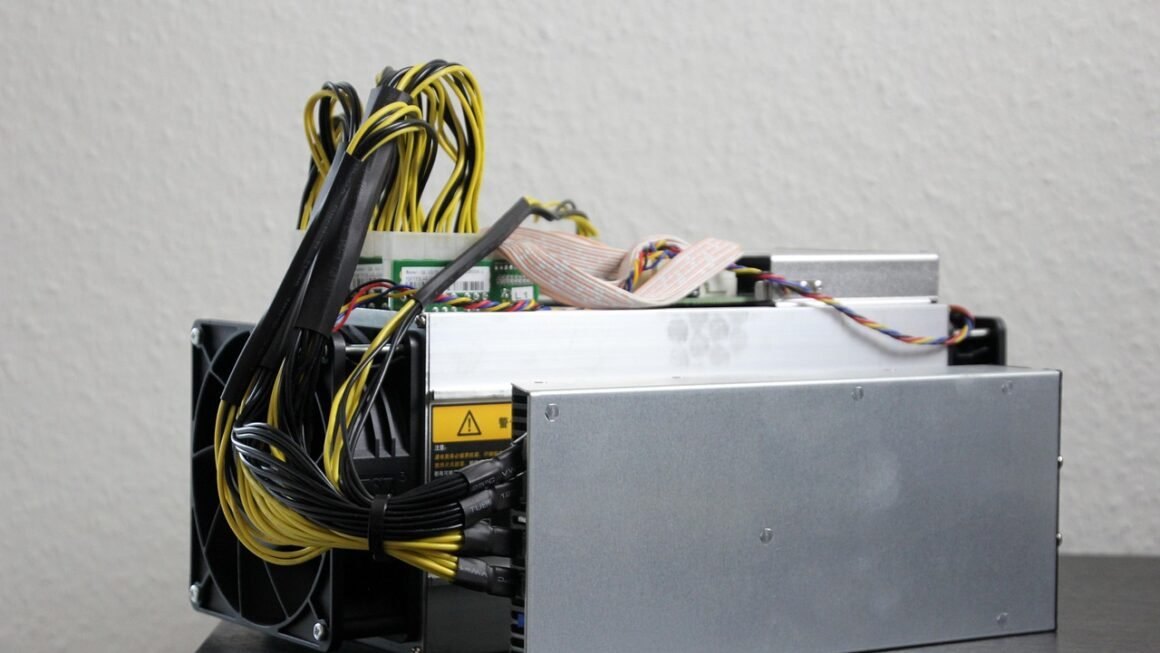

Mining and Staking Rewards

Cryptocurrency mining and staking rewards are also considered taxable income. The fair market value of the crypto at the time you receive it is taxable.

- Mining: Creating new blocks on a blockchain through computational power.

- Staking: Holding crypto in a wallet to support the operations of a blockchain network and earning rewards.

Airdrops

Receiving free cryptocurrency tokens as part of an airdrop is generally considered taxable income. The fair market value of the airdropped tokens when they are received is reported as income.

Determining Your Cost Basis

What is Cost Basis?

Your cost basis is the original price you paid for an asset, including any transaction fees. It’s crucial for calculating capital gains and losses.

Methods for Calculating Cost Basis

- First-In, First-Out (FIFO): Assumes the first crypto you acquired is the first crypto you sell.

- Last-In, First-Out (LIFO): Assumes the last crypto you acquired is the first crypto you sell (generally not allowed for tax purposes).

- Specific Identification: Allows you to choose which specific units of crypto you’re selling. This requires detailed record-keeping.

- Average Cost: Calculates the average cost of all units of a particular cryptocurrency and uses that as the cost basis.

- Example: You bought 1 BTC for $20,000 on January 1, and another 1 BTC for $25,000 on March 1. You sell 1 BTC on July 1 for $30,000.

- FIFO: You’d use the $20,000 cost basis, resulting in a $10,000 capital gain.

- Specific Identification: If you can specifically identify which BTC you sold (the one bought on March 1), you’d use the $25,000 cost basis, resulting in a $5,000 capital gain.

- Choosing the Right Method: The best method depends on your specific situation and record-keeping abilities. Specific identification can be beneficial for tax optimization but requires meticulous records.

Capital Gains: Short-Term vs. Long-Term

Understanding Capital Gains

Capital gains are profits you make from selling an asset for more than you paid for it. The tax rate depends on how long you held the asset before selling it.

Short-Term Capital Gains

- Assets held for one year or less.

- Taxed at your ordinary income tax rate (the same rate you pay on your salary).

Long-Term Capital Gains

- Assets held for more than one year.

- Taxed at preferential rates, which are generally lower than ordinary income tax rates (0%, 15%, or 20% depending on your income).

- Example: You buy BTC on January 1, 2023, and sell it on December 31, 2023. It’s a short-term capital gain, taxed at your ordinary income rate. If you sell it on January 2, 2024, it’s a long-term capital gain, potentially taxed at a lower rate.

- Tax Planning Tip: Holding crypto for over a year can result in significant tax savings due to the lower long-term capital gains rates.

Crypto Tax Software and Tools

Why Use Crypto Tax Software?

Calculating crypto taxes manually can be complex and time-consuming, especially with numerous transactions. Crypto tax software automates the process and helps ensure accuracy.

Features to Look for in Crypto Tax Software

- Transaction Import: Ability to import transaction data from various exchanges and wallets.

- Cost Basis Calculation: Automatically calculates cost basis using different methods.

- Tax Form Generation: Generates necessary tax forms, such as Form 8949 (Sales and Other Dispositions of Capital Assets).

- Error Reconciliation: Identifies potential errors or discrepancies in your transaction data.

- Audit Trail: Provides a detailed audit trail of your calculations for potential IRS audits.

Popular Crypto Tax Software Options

Examples include:

- CoinTracker

- TaxBit

- Koinly

- ZenLedger

- Important Note:* While crypto tax software can greatly simplify the process, it’s essential to review the results carefully and consult with a tax professional if needed.

Conclusion

Navigating crypto taxes requires understanding how the IRS classifies cryptocurrency, recognizing taxable events, accurately calculating your cost basis, and being aware of short-term vs. long-term capital gains implications. Utilizing crypto tax software can streamline the process. However, for complex situations, consulting with a qualified tax professional is highly recommended to ensure compliance and minimize your tax liability. Keeping meticulous records of all your crypto transactions is key to a smooth tax reporting experience.