Trading in today’s globalized world relies heavily on exchanges, the engines driving commerce and investment. From bustling stock markets to innovative cryptocurrency platforms, exchanges facilitate the buying and selling of assets, connecting buyers and sellers efficiently and transparently. Understanding the intricacies of exchanges is vital for anyone looking to participate in the modern financial landscape. Let’s delve into the world of exchanges and explore their significance, types, and operational mechanisms.

What is an Exchange?

Definition and Purpose

An exchange is a centralized marketplace where buyers and sellers can trade assets. These assets can include stocks, bonds, commodities, currencies, or cryptocurrencies. The primary purpose of an exchange is to provide a regulated and transparent environment for price discovery and efficient trade execution. By centralizing trading activity, exchanges ensure liquidity, reduce transaction costs, and offer a level playing field for all participants.

- Price Discovery: Exchanges allow the forces of supply and demand to determine the fair market value of an asset.

- Liquidity: Centralized trading ensures that there are always buyers and sellers available, making it easier to execute trades quickly.

- Transparency: Exchange rules and regulations promote transparency, reducing the risk of manipulation and insider trading.

Key Functions of an Exchange

Exchanges perform several crucial functions that support the trading process:

- Order Matching: They match buy and sell orders based on price and time priority.

- Clearing and Settlement: Exchanges facilitate the clearing and settlement process, ensuring that trades are completed efficiently and securely.

- Market Surveillance: They monitor trading activity to detect and prevent market manipulation and illegal activities.

- Information Dissemination: Exchanges provide real-time market data, including prices, volumes, and other relevant information.

Types of Exchanges

Stock Exchanges

Stock exchanges are perhaps the most well-known type of exchange. They facilitate the buying and selling of shares of publicly traded companies. Major stock exchanges include:

- New York Stock Exchange (NYSE): One of the largest stock exchanges globally, known for its strict listing requirements and blue-chip companies.

- NASDAQ: Focuses on technology and growth companies, often characterized by higher volatility.

- London Stock Exchange (LSE): A key player in the European market, offering access to a wide range of international securities.

- Tokyo Stock Exchange (TSE): The primary stock exchange in Japan, reflecting the country’s economic strength.

- Example: Investing in Apple (AAPL) requires going through a stock exchange like the NASDAQ where AAPL is listed. Investors place buy orders, and the exchange matches them with sell orders from other investors.

Commodity Exchanges

Commodity exchanges deal with raw materials and primary agricultural products. These exchanges allow producers, consumers, and speculators to trade contracts based on the future delivery of commodities.

- Chicago Mercantile Exchange (CME): Offers futures and options contracts on a wide range of commodities, including agricultural products, energy, and metals.

- New York Mercantile Exchange (NYMEX): Specializes in energy and metals trading.

- London Metal Exchange (LME): Focuses on industrial metals trading, setting global benchmark prices.

- Example: A farmer might use the CME to hedge against potential price declines in corn by selling futures contracts, guaranteeing a certain price for their crop.

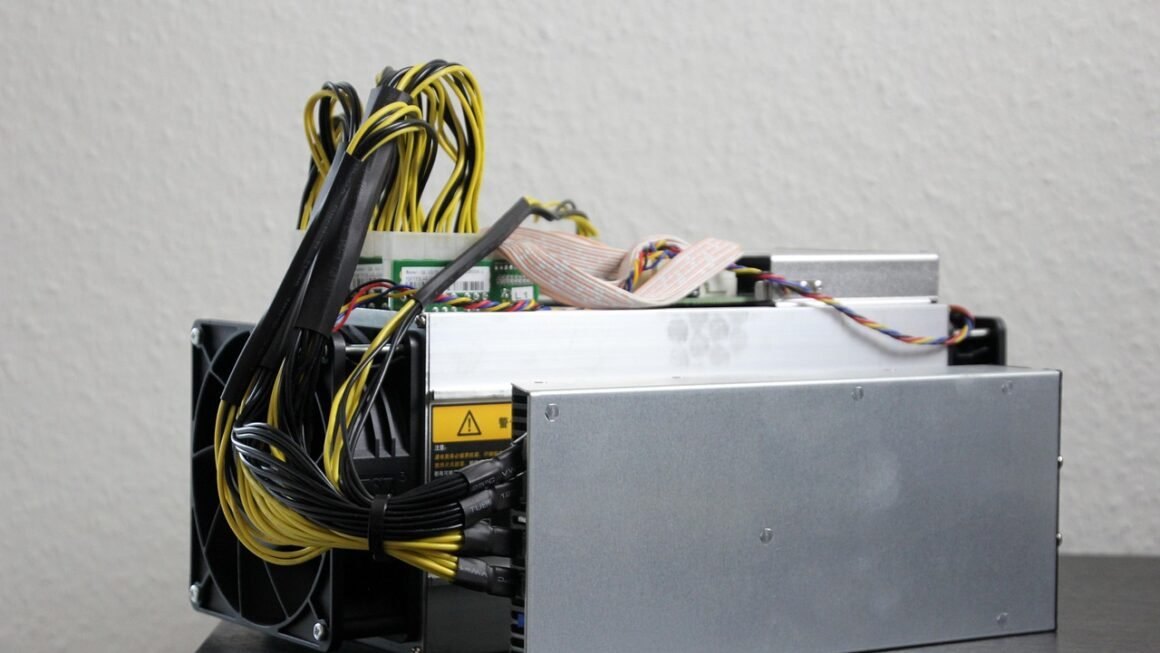

Cryptocurrency Exchanges

Cryptocurrency exchanges facilitate the buying, selling, and trading of digital assets like Bitcoin, Ethereum, and other cryptocurrencies.

- Centralized Exchanges (CEX): These exchanges are operated by a central authority, providing custody and order matching services. Examples include Binance, Coinbase, and Kraken.

- Decentralized Exchanges (DEX): DEXs operate on blockchain technology, allowing users to trade directly with each other without intermediaries. Examples include Uniswap and SushiSwap.

- Example: Someone wanting to buy Bitcoin (BTC) could use Coinbase (a CEX) to exchange fiat currency (like USD) for BTC. Alternatively, they could use Uniswap (a DEX) to trade another cryptocurrency (like ETH) for BTC directly with another user.

Foreign Exchange (Forex) Markets

While not a single, centralized exchange, the foreign exchange market is a decentralized global marketplace where currencies are traded. Forex trading is conducted electronically over-the-counter (OTC).

- Major Forex Centers: Key trading hubs include London, New York, Tokyo, and Singapore.

- Currency Pairs: Currencies are traded in pairs, such as EUR/USD (Euro vs. US Dollar) or GBP/JPY (British Pound vs. Japanese Yen).

- Example: A company needing to pay suppliers in Euros might use the Forex market to exchange US dollars for Euros. Speculators also trade currency pairs to profit from exchange rate fluctuations.

How Exchanges Work

Order Types

Exchanges support various order types, enabling traders to execute trades according to their strategies:

- Market Order: An order to buy or sell an asset immediately at the best available price.

- Limit Order: An order to buy or sell an asset at a specific price or better.

- Stop-Loss Order: An order to sell an asset when it reaches a certain price, designed to limit potential losses.

- Stop-Limit Order: A combination of a stop-loss and a limit order.

Order Matching

Exchanges use sophisticated algorithms to match buy and sell orders. The most common matching methods are:

- Price Priority: Orders are matched based on the best available price.

- Time Priority: Orders with the same price are matched based on the time they were entered.

Clearing and Settlement

After a trade is executed, the exchange facilitates the clearing and settlement process. This involves verifying the trade, transferring ownership of the asset, and ensuring that funds are transferred between the buyer and seller. Clearinghouses play a crucial role in guaranteeing the integrity of the settlement process.

The Role of Regulation

Importance of Regulation

Regulation is essential for maintaining fair, orderly, and efficient markets. Regulatory bodies oversee exchanges and market participants to prevent fraud, manipulation, and other illegal activities.

- Investor Protection: Regulations protect investors from unfair practices and ensure that they have access to accurate information.

- Market Integrity: Regulatory oversight helps maintain market integrity and fosters confidence in the trading process.

- Financial Stability: Regulation helps prevent systemic risks that could threaten the stability of the financial system.

Key Regulatory Bodies

- Securities and Exchange Commission (SEC) (USA): Oversees the securities markets, including stock exchanges.

- Financial Conduct Authority (FCA) (UK): Regulates financial firms and markets in the UK.

- Commodity Futures Trading Commission (CFTC) (USA): Regulates the commodity futures and options markets.

- Actionable Takeaway:* Before participating in any exchange, research the regulatory environment and ensure that the exchange is properly regulated. This provides a layer of protection and ensures compliance with legal standards.

Conclusion

Exchanges are the cornerstone of modern finance, providing platforms for efficient price discovery, liquidity, and trade execution. Whether dealing with stocks, commodities, cryptocurrencies, or currencies, understanding how exchanges function is crucial for investors and traders alike. By adhering to regulations and utilizing various order types, participants can navigate the complexities of the exchange environment and achieve their financial objectives. As technology evolves, exchanges continue to adapt and innovate, playing an increasingly important role in the global economy.