Navigating the world of cryptocurrency can be exciting, but it also comes with responsibilities, especially when it comes to taxes. Understanding how your crypto activities are taxed is crucial to avoid penalties and ensure compliance with tax regulations. This guide will walk you through the essential aspects of crypto taxes, providing practical examples and actionable tips to help you stay on top of your obligations.

Understanding Cryptocurrency and Tax Implications

Cryptocurrency, while revolutionary, isn’t treated as legal tender in many countries. For tax purposes, most jurisdictions, including the United States, classify cryptocurrency as property. This classification has significant implications for how crypto transactions are taxed.

Crypto as Property: What Does It Mean?

Treating cryptocurrency as property means that it’s subject to capital gains taxes, similar to stocks or bonds. Every time you sell, trade, or otherwise dispose of cryptocurrency, you may trigger a taxable event.

- Capital Gains Taxes: Profits from selling crypto are taxed as either short-term or long-term capital gains, depending on how long you held the asset.

Short-term capital gains (assets held for one year or less) are taxed at your ordinary income tax rate.

Long-term capital gains (assets held for more than one year) are taxed at preferential rates, which are generally lower than ordinary income tax rates (0%, 15%, or 20% depending on your income bracket in the US, for example).

Taxable Events in the Crypto World

Several crypto activities can trigger a taxable event. Understanding these is the first step in managing your crypto taxes effectively.

- Selling Cryptocurrency: Selling crypto for fiat currency (like USD or EUR) is a taxable event.

Example: You bought 1 Bitcoin (BTC) for $30,000 and sold it for $60,000. You have a capital gain of $30,000.

- Trading Cryptocurrency: Exchanging one cryptocurrency for another is also taxable.

Example: You traded 1 Ethereum (ETH) for 2 Bitcoin (BTC). This is treated as selling ETH and buying BTC, triggering a taxable event based on the fair market value of ETH at the time of the trade.

- Spending Cryptocurrency: Using crypto to purchase goods or services is a taxable event.

Example: You bought a laptop for $2,000 worth of Bitcoin. If the Bitcoin’s cost basis was $1,000, you have a capital gain of $1,000.

- Receiving Cryptocurrency as Income: If you receive crypto as payment for goods, services, or as salary, it’s considered taxable income.

Example: You received 0.5 BTC as payment for freelance work. The fair market value of that 0.5 BTC at the time you received it is considered taxable income.

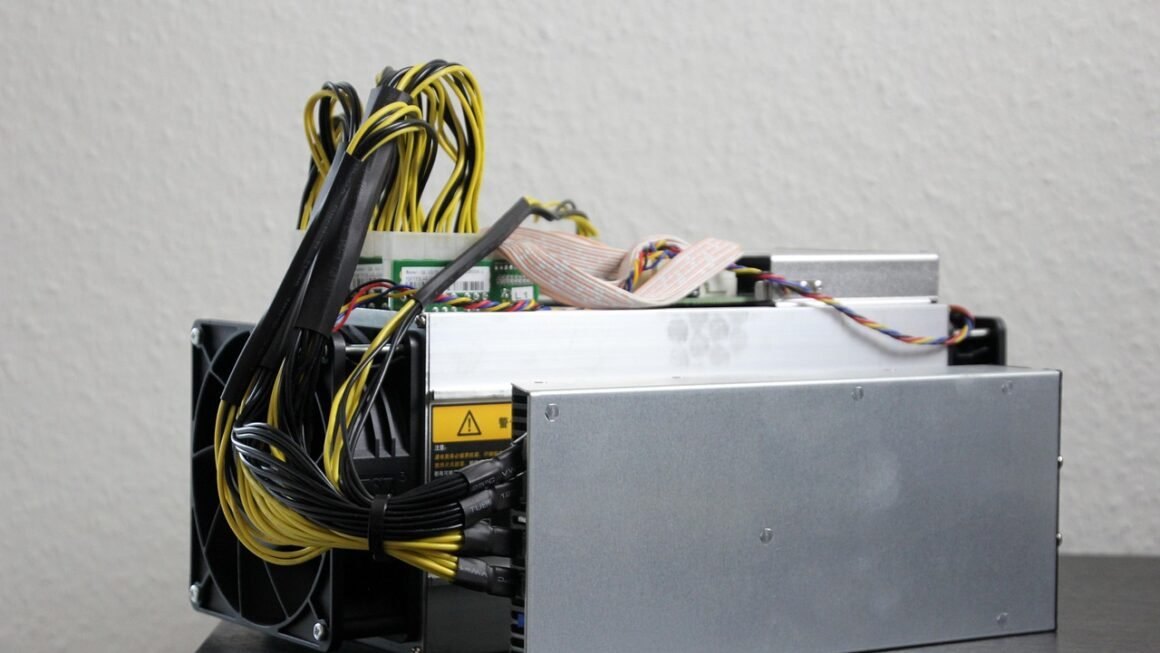

- Mining Cryptocurrency: The fair market value of the cryptocurrency you mine is taxable income when you gain control of it. You may also be able to deduct related expenses like electricity and equipment depreciation.

Calculating Your Crypto Taxes: Key Concepts

Calculating your crypto taxes involves understanding several key concepts, including cost basis, fair market value, and specific identification methods.

Cost Basis: Knowing What You Paid

Cost basis is the original purchase price of your cryptocurrency, including any fees you paid to acquire it. It’s essential for calculating capital gains or losses.

- Determining Cost Basis:

Keep accurate records of your crypto purchases, including the date, price, and quantity.

For crypto acquired through mining or staking, the cost basis is the fair market value at the time you gained control of the asset.

Fair Market Value (FMV): What is it Worth?

Fair Market Value (FMV) is the price at which an asset would change hands between a willing buyer and a willing seller, both having reasonable knowledge of the relevant facts. This is important when receiving crypto as income or when calculating gains/losses from trading.

- Finding FMV:

Use reputable cryptocurrency exchanges to determine the FMV of your crypto at the time of the transaction.

Document the exchange rate and the source of the information for your records.

Specific Identification vs. FIFO

When selling or trading cryptocurrency, you need to determine which specific units you are disposing of. There are different methods you can use.

- Specific Identification: You choose which specific units of crypto you are selling. This requires meticulous tracking but can allow you to optimize your tax liability by selling assets with higher or lower cost bases.

Example: You bought 1 BTC on January 1st for $30,000 and another 1 BTC on June 1st for $40,000. If you sell 1 BTC in December for $50,000 and you specifically identify that you are selling the one purchased on January 1st, your capital gain is $20,000.

- FIFO (First-In, First-Out): The first crypto you bought is assumed to be the first crypto you sold. This is the default method if you don’t specifically identify the units you are selling.

Crypto Tax Software and Tools

Given the complexity of crypto taxes, using specialized software and tools can be incredibly helpful.

Benefits of Using Crypto Tax Software

- Automated Calculations: Automatically calculates capital gains and losses based on your transaction history.

- Integration with Exchanges: Connects to various crypto exchanges and wallets to import transaction data seamlessly.

- Tax Form Generation: Generates the necessary tax forms, such as Form 8949 (for capital gains and losses) and Schedule D (Capital Gains and Losses).

- Error Detection: Helps identify potential errors or discrepancies in your records.

- Time Savings: Saves significant time and effort compared to manual calculations.

Popular Crypto Tax Software Options

- CoinTracker: Integrates with many exchanges and wallets, offers tax loss harvesting tools, and provides detailed reporting.

- Koinly: Supports a wide range of cryptocurrencies and exchanges, offers advanced cost basis methods, and generates audit reports.

- TaxBit: Focuses on enterprise-level solutions and offers robust tax reporting features.

Tips for Choosing Crypto Tax Software

- Check Compatibility: Ensure the software supports your exchanges and wallets.

- Consider Pricing: Compare pricing plans and features to find the best value for your needs.

- Read Reviews: Look for user reviews to assess the software’s accuracy and ease of use.

- Look for Support: Ensure the software offers adequate customer support in case you need assistance.

Strategies for Managing Your Crypto Taxes

Effective planning can significantly reduce your tax burden and ensure compliance.

Tax Loss Harvesting

Tax loss harvesting involves selling cryptocurrencies at a loss to offset capital gains. This can lower your overall tax liability.

- How It Works:

Identify crypto assets that have decreased in value.

Sell these assets to realize a capital loss.

Use the capital loss to offset capital gains from other crypto transactions or other investments.

- Wash Sale Rule: Be aware of the wash sale rule, which prevents you from repurchasing the same or substantially identical asset within 30 days before or after the sale to claim the loss. This rule generally does not apply to cryptocurrency in the US. However, careful consideration should be given if there’s guidance in the future.

Keeping Accurate Records

Maintaining detailed records of all your crypto transactions is crucial for accurate tax reporting.

- What to Record:

Date of each transaction

Type of transaction (buy, sell, trade, etc.)

Amount of cryptocurrency involved

Fair market value at the time of the transaction

Cost basis of the cryptocurrency

Exchange or wallet used

Seeking Professional Advice

If you have complex crypto transactions or are unsure about your tax obligations, consider consulting a tax professional with expertise in cryptocurrency.

- Benefits of Professional Advice:

Accurate tax planning and compliance

Identification of potential tax-saving opportunities

Assistance with complex tax situations

Peace of mind knowing you are meeting your tax obligations

Conclusion

Navigating crypto taxes can seem daunting, but with a solid understanding of the rules and the right tools, you can manage your tax obligations effectively. Remember to keep accurate records, consider using crypto tax software, and seek professional advice when needed. By staying informed and proactive, you can confidently navigate the evolving landscape of cryptocurrency and taxation.